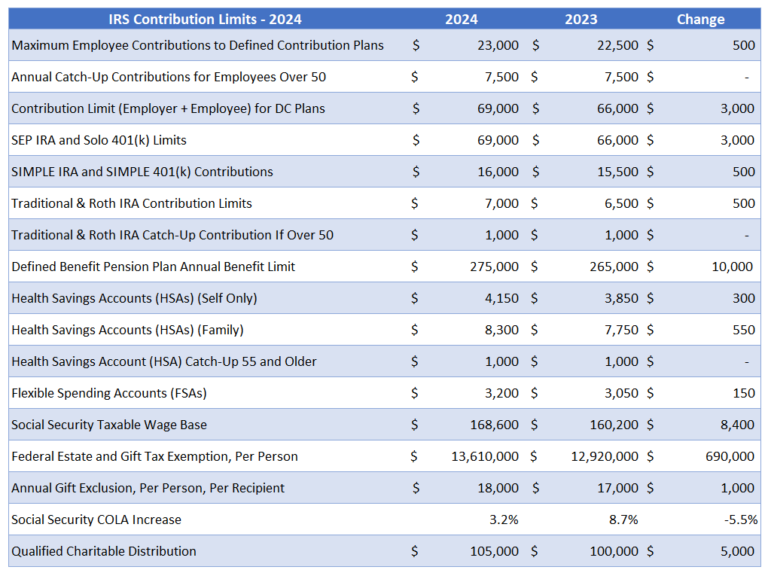

Ira Contribution Limits 2025 Income 2025 - 2025 Contribution Limits Announced by the IRS, This article provides a comprehensive overview of the current limits for individuals and employers. Ira contribution limit increased for 2025. 401k 2025 Contribution Limit IRA 2025 Contribution Limit, The deal gets sweeter for those aged 50 and older, who can contribute an additional $1,000. The deduction may be limited if you or your spouse is covered by a.

2025 Contribution Limits Announced by the IRS, This article provides a comprehensive overview of the current limits for individuals and employers. Ira contribution limit increased for 2025.

IRA Contribution Limits 2025 Finance Strategists, Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth. Here are the 2025 401k contribution limits.

The maximum total annual contribution for all your iras (traditional and roth) combined is:

2025 IRA Maximum Contribution Limits YouTube, The total contribution limit for iras in 2025 is $7,000. Stay up to date with the ira contribution limits for 2025.

Sep Ira 2025 Contribution Limits Ruthi Clarisse, Learn how ira income limits vary based on which type of ira you have. The total contribution limit for iras in 2025 is $7,000.

2025 ira contribution limits Inflation Protection, $6,500 (for 2023) and $7,000 (for 2025) if you're under age 50. The contribution limit for individual retirement accounts (iras) for the 2025 tax year is $7,000.

The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Ira Limits 2025 Over 50 Heda Rachel, Ira contribution limit increased for 2025. These were announced by the irs on november 4, 2025.

The limit on annual contributions to an ira increased to $7,000 in 2025, up from $6,500 in 2023—that limit applies to the total amount contributed to your traditional. Roth ira contribution and income limits:

Roth Limits 2025 Miran Tammara, Even if you contribute 5%, the employer still only contributes 3%. The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

2025 Ira Limits Ajay Lorrie, Here are the 2025 401k contribution limits. The maximum total annual contribution for all your iras (traditional and roth) combined is: